In the world of investing, continuous learning is key. We can't always find actionable investment opportunities every day, but we can always dedicate time to understanding the intricacies of different businesses and industries. This knowledge builds a foundation that prepares us to identify opportunities when they do arise. Today, let's delve into a critical aspect of the aerospace industry's business model: aftermarket services, specifically Long-Term Service Agreements (LTSAs) and the strategic importance of "Time on Wing."

The Power of Long-Term Service Agreements (LTSAs)

For major aero engine manufacturers like Rolls-Royce, the sale of an engine is often just the beginning of a long-term relationship with an airline customer. Most engines sold are maintained under Long-Term Service Agreements (LTSAs), frequently referred to in the industry as "Power by the Hour" contracts. Under an LTSA, the airline pays an amount per engine flying hour (EFH). In return, Rolls-Royce agrees to maintain the engine to an agreed standard, ensuring safety compliance (like Airworthiness Directives), and optimal performance.

These contracts are long-term commitments. For large (widebody) engines, the first contract is typically 12 or more years, while a second contract might be around 8 years. The average duration for existing large engine LTSA contracts is approximately 8 years. Over 90% of Trent engines are covered by LTSAs, and over 70% of Business Aviation and Regional engines are as well. Rolls-Royce offers different types of LTSAs, including TotalCare® for large engines and CorporateCare® for Business Aviation.

What an LTSA Covers and the Benefits

LTSA contracts are comprehensive, typically including maintenance, repair & overhaul services, engine reliability improvements, Engine Health Monitoring (EHM) analysis, specialist line maintenance, Aircraft on Ground (AoG) support, and TotalCare® services integration. LTSA engines also benefit from Time on Wing improvements made during the life of the programme. Airlines can also choose optional services like materials management, spare engine services, engine change/transportation, and customer training.

The benefits for airlines are significant: OEM-level maintenance and support, maximized aircraft availability and reliability, predictability of engine maintenance costs (aligned with airline revenues), and predictability of cashflow.

For Rolls-Royce, LTSAs provide upfront cash receipts and increased predictability of cash flows, potentially leading to a higher Net Present Value (NPV). They foster strong, long-term relationships with airlines, offer insights into fleet dynamics and future opportunities, and provide valuable data on product performance. LTSAs also offer a greater ability to manage shop visit and engineering capacity and focus R&D investments.

The Economics of LTSAs and the EFH Rate

The LTSA economic model is based on a clear understanding of an engine's costs over its life, influenced by how the engine is used. Factors like stage length and thrust de-rate affect servicing requirements and costs. To reflect this usage variation, each EFH contract has a matrix where the airline pays a different rate depending on how the engine is being used. The EFH rate is set based on the estimated costs, targeting a specific margin and NPV. Rolls-Royce uses data collection for rapid intervention.

LTSA contracts are profitable, assuming correct pricing and good cost management. Rolls-Royce reports becoming more sophisticated at estimating costs and pricing LTSAs based on growing data and experience.

Time on Wing: A Key Profitability Lever

Time on Wing (ToW) is the duration an engine can remain installed on the aircraft between shop visits. It is identified as one of six levers to improve LTSA profitability. Rolls-Royce is making a significant investment of £1 billion to increase Time on Wing. The target is an average 40% Time on Wing increase over the mid-term.

Extending Time on Wing means keeping engines earning for longer on the aircraft. This strategy, along with lowering shop visit costs, reducing product costs, implementing value-based pricing, driving contractual rigour, and improving pricing/execution on contracts, is aimed at improving LTSA margins.

The goal is to improve Time on Wing for modern engines like the Trent 1000, Trent 7000, Trent XWB-84, and Trent XWB-97. Specific targets include:

For the Trent XWB-97, doubling Time on Wing in non-benign environments by the end of 2027. This means increasing it from the current 18-24 months to a Phase 3 target of 3-4 years (a +100% increase). In benign environments, the target is 4-6 years from a current 3-4 years (+50%). These improvements involve features like advanced disc materials, optimised combustors, increased TGT margin, redesigned HPT blades & NGVs, and various coatings and modifications.

For the Trent 7000, improving Time on Wing to more than 4 years with Phase 2 enhancements, up from approximately 3 years today (a +30% increase). Phase 2 enhancements include advanced coatings, HP NGV changes, and HPT blade optimization.

For the Trent 1000 TEN, targeting approximately 5 years Time on Wing with Phase 1 improvements (a ~30% increase from ~4 years today), and potentially over 5 years with Phase 2 (a >100% increase from ~4 years today). Enhancements involve blade and cooling optimisations, a new combustor part, software updates, and advanced coatings.

Rolls-Royce is leveraging innovation and data analytics to extend Time on Wing in service, using tools like intelligent borescope inspections, extending High-Pressure Turbine Blade (HPTB) limits based on evidence, whole engine maturity sampling, and engine wash systems.

Demand, Flight Hours (EFH), and Shop Visits (SVs)

Demand for LTSA services is directly tied to engine flying hours (EFH). Rolls-Royce expects large engine flying hours to grow between 120% to 130% of 2019 levels by the mid-term. Business Aviation also contributes significantly, with engine deliveries expected to increase. LTSA balance growth is expected, driven by increasing EFH receipts, higher average rates per EFH, and Time on Wing improvements (especially post-2027).

The usage of engines (EFH/cycles) drives the timing of shop visits. Rolls-Royce has good visibility over engine usage and SV timing, which allows them to manage MRO capacity. Shop visit volumes are predictable; absent major disruptions, Rolls-Royce expects 700-750 major refurbs in the mid-term.

If fewer shop visits are needed than expected in a contract due to better Time on Wing, the customer still pays based on EFHs flown. This could result in a higher contract margin and a positive "contract catch-up".

Accounting Treatment under IFRS15

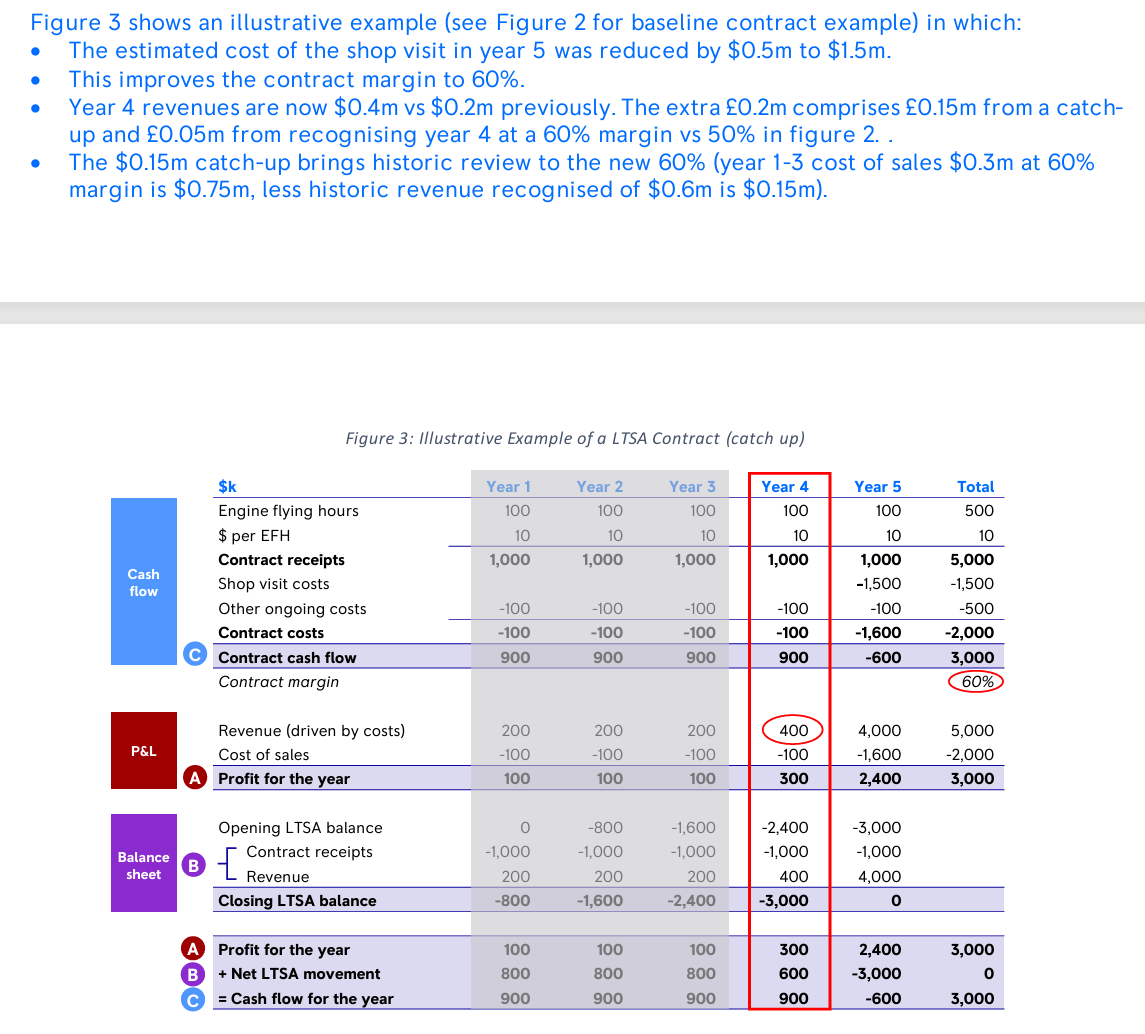

Under IFRS15, introduced in 2018, revenues and profits for LTSAs are recognised as costs are incurred. This means that most revenues and profits are recognised in the year when shop visits occur, which are the most significant costs. Cash receipts, however, are received based on EFHs flown, often accruing evenly each year.

This difference between the timing of cash flows and the recognition of revenue/profit under IFRS15 results in a "net LTSA liability" on the balance sheet. This liability represents deferred income. Over the life of the contract, total cash flows and total IFRS15 profits will be equal, but they will almost never be equal in any single year. The LTSA balance is not treated as debt by credit rating agencies.

LTSA margins are estimated based on expected revenues (from flying hours and EFH rates) and estimated costs (SVs and other contract costs), including a contingency layer. These assumptions are reviewed annually. If assumptions change (e.g., lower estimated shop visit costs), the long-term contract margin changes. This triggers a "contract catch-up" to true-up historical IFRS15 profits to the new margin assumption. Catch-ups can be positive (if margins improve) or negative (if margins worsen).

Critical Issues, Risks, and Key Considerations

Onerous Contracts: Historically, some contracts were loss-making. Rolls-Royce is actively renegotiating these "onerous" contracts with airlines, seeking win-win solutions. Progress in these negotiations led to a significant provision release in 2023.

Inflation: LTSAs have inflation-linked "escalation" mechanisms built in to mitigate the impact of inflation, referenced to spare parts prices or agreed industry cost baskets (labour, energy, raw materials). Rolls-Royce also hedges raw material purchases and targets cost savings.

Falling Short on ToW: If the Time on Wing improvement plan falls short, it could result in a negative contract catch-up due to lower expected margins, increased shop visits (mostly after 2027), and a drag on cash flows and contract margins.

Aircraft Sales/Retirement: If an aircraft is sold or retired before the minimum contract term, Rolls-Royce may be entitled to claim losses or compensation from the airline. If sold to another airline, Rolls-Royce would seek a new LTSA contract with the new operator.

Unbundled LLPs: Approximately half of current LTSA contracts are "unbundled" for Life-Limited Parts (LLPs). A growing percentage of new contracts are unbundled, adding flexibility. Rolls-Royce has increased LLP prices in recent years.

Spare Engines: Spare engines are crucial for operational performance and resilience. LTSA contracts include a healthy level of spare coverage, typically 10-15% of large engine deliveries. While airlines often buy spare engines (resulting in a lower EFH rate), Rolls-Royce can provide them for airlines that prefer not to own them, at a substantially higher EFH rate.

Visibility and Management: Rolls-Royce emphasizes its high degree of visibility over shop visit volumes and engine usage, allowing them to manage MRO capacity effectively. Delivery delays, while possible, are often transparent with partners like Airbus and Boeing, allowing for forecast adjustments.

In summary, Long-Term Service Agreements, supported by strategic initiatives like increasing Time on Wing, are fundamental to the financial health and predictability of aero engine manufacturers' aftermarket business. Understanding the economics, accounting, and operational factors involved provides valuable insight into this complex but rewarding sector.