Why Federal Reserve Independence Matters: Understanding the Implications of Political Pressure

The Federal Reserve (Fed) plays a crucial role in the American economy, influencing everything from interest rates to job availability. As the nation's central bank, it operates with a degree of independence from the direct control of the President and Congress. This independence is not accidental; it's a deliberate structural feature designed to safeguard the economy from short-term political pressures.

Why is Fed Independence So Important?

Economists widely agree that an independent central bank is more effective at maintaining stable price levels. The rationale behind this rests on several key points:

Avoiding Short-Term Political Manipulation: Elected politicians might be tempted to push for lower interest rates to stimulate the economy before an election, even if it risks higher inflation later. This can lead to unsustainable "boom-bust cycles" that ultimately harm the economy. Independent central bankers can make unpopular but necessary decisions, such as raising interest rates to curb inflation, without fear of political repercussions.

Focus on Long-Term Economic Goals: Congress has tasked the Fed with the "dual mandate" of promoting maximum employment and stable prices. Independence allows the Fed to focus on achieving these long-term goals using the best available evidence and analysis, without being swayed by immediate political concerns.

Enhanced Credibility and Policy Effectiveness: An independent Fed is seen as more credible by financial markets, which can lead to its policies having a more predictable and desired effect.

What Does "Independence Within the Government" Mean?

The Fed is an independent agency within the government, meaning it's not subject to the direct control of the executive branch. This independence is supported by several factors:

Appointments and Terms: Members of the Board of Governors (including the Chair) are nominated by the President and confirmed by the Senate, but they serve long, staggered 14-year terms, limiting the influence of any single administration. The Chair serves a four-year term and can be reappointed.

Protection from Removal: Fed governors can only be removed by the President "for cause," not simply due to policy disagreements. Legal precedent, such as Humphrey’s Executor v. United States, supports this protection for members of multi-member regulatory bodies like the Fed.

Financial Autonomy: Unlike most government agencies, the Fed does not rely on congressional appropriations for its funding. Its income comes primarily from interest earned on government securities. This financial independence further insulates it from political pressure related to budget decisions.

Policy Decisions: The Fed has the freedom to deploy its tools, primarily interest rates, to achieve the economic goals set by Congress, without direct interference from the White House or Congress.

President Trump's Statements Regarding Fed Chairman Jerome Powell: A Threat to Independence?

The sources indicate that President Trump expressed dissatisfaction with the Federal Reserve's interest rate policies. Kevin Hassett, then director of the White House National Economic Council, declined to defend Fed Chair Jerome Powell, alleging that the central bank had been motivated by political considerations. This public criticism and the administration's willingness to "study" Powell's status could be interpreted as a challenge to the Fed's independence.

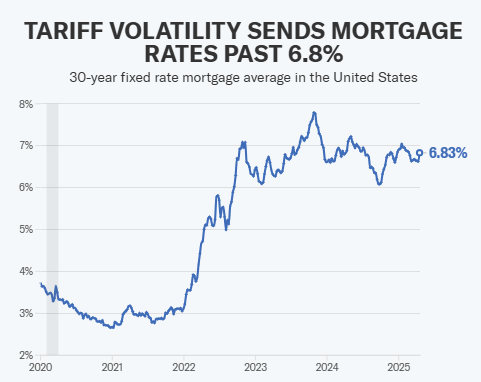

30-Year Mortgage Fixed Rate

While President Trump stated he didn't plan to fire Powell, the very suggestion and public criticism raise concerns about potential political influence over monetary policy. The resignation of the Fed's vice chair for supervision, Michael Barr, to avoid a legal battle over potential firing, further underscores the tension surrounding the issue.

Speculating on the Consequences of Firing the Fed Chair and Compromising Fed Independence:

Firing a Fed Chair without legitimate "cause" and otherwise compromising the Fed's independence could have significant negative consequences for the economy and the institution itself:

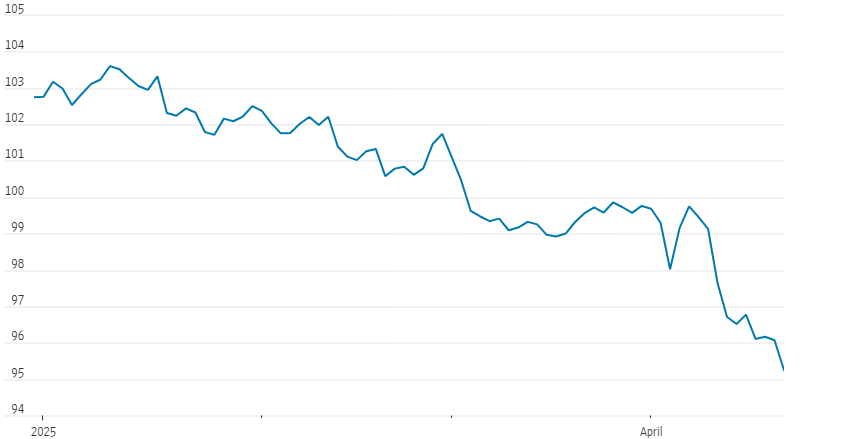

Erosion of Credibility: Such an action would likely shake confidence in the Fed's independence among investors, businesses, and the public. This could lead to increased market volatility and uncertainty. The dollar's decline against other major currencies during the period of criticism might be indicative of such concerns.

Political Influence on Monetary Policy: If the President could easily remove the Fed Chair for policy disagreements, future chairs might feel pressure to align their decisions with the administration's short-term political goals rather than focusing on the long-term health of the economy. This could lead to poor monetary policy decisions, potentially resulting in higher inflation, economic instability, and boom-bust cycles.

Damage to the Fed's Ability to Function Effectively: An environment where the Fed is constantly under political threat could undermine the morale and effectiveness of its staff. It might become more difficult to attract and retain top economic talent if the institution's independence is perceived to be compromised.

Increased Political Polarization of Monetary Policy: Monetary policy decisions, which are best made based on economic data and analysis, could become increasingly politicized, further eroding public trust in the institution.

International Repercussions: The independence of a central bank is a widely accepted principle in developed economies. Compromising the Fed's independence could damage the United States' economic reputation and its standing in the global financial system.

Dollar Index

In conclusion, the independence of the Federal Reserve is a cornerstone of sound economic policy. Threats to this independence, such as public pressure and the suggestion of removing the Fed Chair for policy disagreements, carry significant risks and could undermine the Fed's ability to effectively manage monetary policy in the long-term interest of the nation. Protecting the Fed's independence is crucial for maintaining economic stability and fostering public trust in this vital institution.

Sponsored by BrainyBeeApp.com

Ever wonder how we quickly synthesize info for this newsletter? We use AI! You can boost your productivity too, thanks to our sponsor, BrainyBeeApp.com.

Get instant answers and insights using top AI models like Google's Gemini, the latest ChatGPT, or Anthropic's Claude. Stuck on a tough calculus problem? Just snap a picture for an instant answer from Brainy Bee, and even ask for detailed step-by-step explanations effortlessly.

The best part? No subscriptions!

AI for business, AI for fun, skip the subscriptions, BrainyBee is number one.

Check them out at BrainyBeeApp.com!