Recent quarterly results from software design powerhouses Dassault Systèmes and Autodesk highlight key trends and challenges impacting the industry, including the ongoing shift to subscription models, navigating global macroeconomic uncertainty, and strategic investments in future growth areas like AI and cloud platforms. While both companies reported solid performance, their results also reflected specific segment weaknesses and the broader effects of the economic climate.

Performance Highlights and Industry Trends

Dassault Systèmes reported a solid start to 2025 with first-quarter results, noting strong subscription growth. Software revenue increased by 5% in constant currencies, driven by a 7% rise in recurring revenue. Subscription growth was particularly strong at 14%. The 3DEXPERIENCE platform continued to be a key driver, with its software revenue growing 17%. Industrial Innovation, housing high-end CAD software like Catia, saw strong growth at 8% in Q1 2025, benefiting from large deals signed previously and increasing adoption of the 3DEXPERIENCE platform. However, growth in Europe was a slow 1%, and the Life Sciences segment, including Medidata, was stable at 0% growth in Q1 2025, impacted by ongoing weakness in the contract research organization (CRO) market, which is expected to worsen before improving. Mainstream Innovation, home to Solidworks, saw low single-digit growth (2% in Q1 2025) due to customer hesitancy, although bookings and 3DEXPERIENCE adoption showed solid momentum.

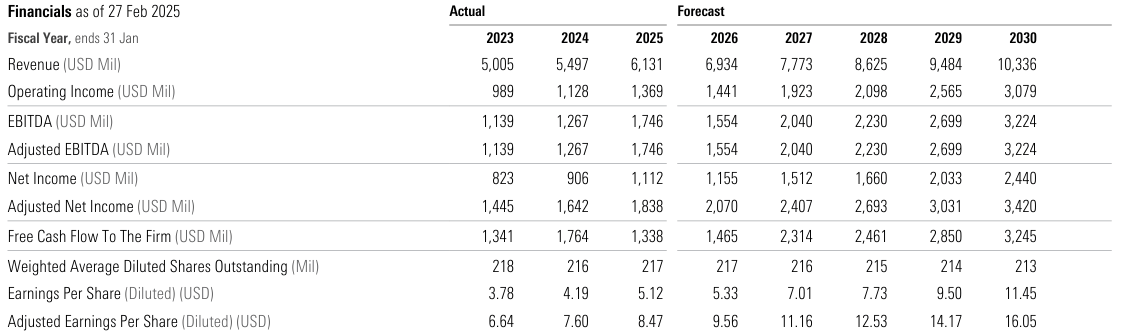

Autodesk also delivered strong fourth quarter and full-year fiscal 2025 results. For FY25, total revenue was $6.13 billion, an increase of 12% as reported. Fourth quarter revenue grew 12% as reported and on a constant currency basis to $1.6 billion. Total billings increased 16% in FY25 and 23% in Q4 FY25. Recurring revenue remained high at 97% of total revenue. The Architecture, Engineering, Construction, and Operations (AECO) segment was a standout performer, growing 14% in FY25 and showing strong momentum driven by cloud-based construction solutions. Manufacturing (MFG) revenue grew 12% in FY25. Geographically, Autodesk saw broad-based growth, with Americas revenue up 11% and EMEA up 13% in FY25.

A significant industry trend reflected in both companies' results is the continued shift towards subscription and cloud-based models. Dassault Systèmes' subscription revenue grew 14% in Q1 2025, and the company views the focus on subscription conversions as beneficial for long-term returns, greater customer retention, and easier upselling. Autodesk's transition to a subscription model has resulted in highly recurring revenue and is believed to make the company significantly more immune from downturns compared to its previous license model.

Another notable trend is the focus on platform strategies and technological advancements. Dassault Systèmes is expanding its 3DEXPERIENCE platform, recently announcing 'Gen 7', which leverages AI and spatial computing to create "3D UNIV+RSES" as a platform for knowledge and know-how. Autodesk is focused on the convergence of design and make in the cloud, enabled by platform, industry clouds, and AI.

Navigating Macroeconomic Uncertainty and Tariffs

Both companies have acknowledged the impact of the global macroeconomic environment. Dassault Systèmes' second-quarter guidance was softer than expected due to tariff-related uncertainty. The company noted that its major customers in automotive, aerospace, and industrial products are directly exposed to tariffs. While growth in the industrial innovation segment was strong, overall growth in Europe was muted, potentially reflecting this uncertainty. Dassault's confirmed 2025 guidance is dependent on strong performance in the second half, and macroeconomic hits may make market growth expectations optimistic. Uncertain global conditions, including potential new customs barriers, are noted as factors that could negatively affect Dassault's business.

Autodesk's Q4 FY25 performance was consistent with prior quarters, showing strong renewal rates but headwinds to new business growth due to the broader economic environment. The company lists global economic and political conditions, foreign exchange headwinds, recessionary fears, supply chain disruptions, and geopolitical tension as risks. Despite these challenges, Autodesk has shown resilience in revenue and strong renewal rates.

Company Valuations and Financial Management

According to Morningstar reports, Dassault Systèmes shares are assessed as undervalued as of April 25, 2025, with a Price/Fair Value Estimate (FVE) of 0.87 and a fair value estimate of EUR 37 (ADR $42). While shares fell 5% on the Q1 results and Q2 guidance, they are still considered undervalued based on the analyst's assessment. The EUR 37 fair value estimate has been consistently maintained across multiple reports from different analysts. For fiscal year 2025, Dassault is targeting total revenue growth of 6-8% and diluted EPS of €1.36-€1.39 (non-IFRS). The company expects adjusted EBIT margin to be around 32% in 2025 and 2026, rising to around 35% thereafter due to operating leverage from its cloud business scaling. Dassault also pays dividends, with €0.30 per share in 2023. Cash flow from operations grew 21% in Q1 2025.

Autodesk shares are assessed as fairly valued as of April 24, 2025, with a Price/FVE of 0.91 and a fair value estimate of $290. The stock price dipped after the Q4 FY25 results, bringing it in line with the fair value estimate. Autodesk's non-GAAP operating margin was 36% in FY25. The company is emphasizing margin expansion as a key value driver and expects to deliver GAAP margins among the best in the industry once its sales and marketing optimization is complete. Autodesk does not currently pay dividends but plans significant share buybacks, intending to buy back between $1.1 billion and $1.2 billion of shares in fiscal 2026, a 30% to 40% increase compared to fiscal 2025. Autodesk generated $1.57 billion in free cash flow in FY25.

The high proportion of recurring revenue from subscriptions for both companies (97% for Autodesk and 86% of software revenue for Dassault Systèmes) contributes significantly to the predictability of their future revenues. Both companies are also targeting margin expansion, contributing to predictability in profitability over the longer term, although near-term performance can be affected by macroeconomic factors and strategic investments.

Competitive Advantages and Risks

Both Dassault Systèmes and Autodesk benefit from wide economic moats built primarily on switching costs. For Autodesk, this stems from the complexity of its products and the significant time and effort users invest in learning and mastering the software, making it costly to switch to a competitor. Widespread training in educational institutions further reinforces a network effect. Dassault Systèmes' wide moat is particularly strong in its Industrial Innovation and Life Sciences segments. Catia, a flagship high-end product, demonstrates strong switching costs with high customer retention rates and long-term customer relationships.

Despite their strong competitive positions, both companies face notable risks. Global macroeconomic conditions, including potential recessionary fears, inflation, and geopolitical issues, can lead customers to reduce, postpone, or cancel investments, impacting revenue growth. Specifically, Dassault Systèmes is affected by weakness in certain markets like the CRO market for Medidata and past customer hesitancy for Solidworks. New competition in the SME CAD and PLM markets is a potential threat to Solidworks' dominance. Autodesk faces risks related to successfully implementing its new transaction model and sales/marketing optimization, which involves a significant workforce reduction. Fluctuations in currency exchange rates also present risks for both international companies.

In summary, the software design industry, as represented by these two leaders, is characterized by a strong foundation of recurring revenue from subscription models and wide competitive moats. While navigating global economic uncertainties and specific segment challenges, both companies are strategically investing in platforms, AI, and operational efficiency to drive future growth and profitability. Dassault Systèmes appears undervalued, while Autodesk is currently assessed as fairly valued.