The first quarter of 2025 revealed a dynamic operating environment for major aerospace engine manufacturers GE Aerospace, RTX (including its Pratt & Whitney segment), and Safran. Despite ongoing complexities, all three companies reported solid financial and operational performance, largely driven by strong demand in the commercial aftermarket.

First Quarter Performance Highlights

RTX: Generated 8% organic sales growth. Segment margin expanded by 120 basis points. Commercial aftermarket sales were up 21% organically. Pratt & Whitney's sales were up 14% on both an adjusted and organic basis, with commercial aftermarket sales seeing a 28% increase driven by higher volume and favorable mix. Collins Aerospace saw organic sales growth of 9%, with commercial aftermarket up 13%. Raytheon's organic sales were up 2%, primarily due to higher volume on land and air defense systems, including international Patriot and LTAMS. RTX reported adjusted earnings per share of $1.47, ahead of expectations.

GE Aerospace: Reported adjusted revenue of $9.0 billion, up 11%. Operating profit was $2.1 billion, up 38% on an adjusted basis. Adjusted earnings per share were $1.49, up 60%. Commercial Engines & Services (CES) revenue was up 14%, with services growing 17% driven by more than 20% growth in spare parts revenue. Defense & Propulsion Technologies (DPT) revenue was up 1%. Orders totaled $12.3 billion, up 12%, with CES orders increasing 15%.

Safran: Reported Q1 2025 adjusted revenue of €7,257 million, up 16.7% compared to Q1 2024 (+13.9% on an organic basis). The Propulsion division's organic revenue was up 16.4%, driven by spare parts growth. Spare parts for civil engines (in $) increased by 25.1%, mainly from CFM56 and high-thrust engines.

Industry Trends: Demand, MRO, and Supply Chain

Demand remains very strong, particularly on the Original Equipment (OE) side, although it is a constrained environment. Airframers have strong backlogs and are focused on production ramps. The commercial aftermarket continues to show tremendous demand.

Maintenance, Repair, and Overhaul (MRO) Activity:

Pratt & Whitney's PW1100 GTF MRO output was up 35% year-over-year and 14% sequentially. The company remains on track for over a 30% improvement for the full year and expects AOGs (Aircraft on Ground) to trend down in the back half of the year.

GTF MRO output was strong on heavier work scopes compared to the prior quarter. The focus is on optimizing flow within shops, particularly improving material flow into Gate 2 to reduce turnaround times.

V2500 engine shop visits are on track, with an estimated 800 shop visits for the full year. Shop visits are trending towards heavier overhauls due to the age of the fleet, and demand remains strong for these engines given the demand in the narrowbody area.

GE Aerospace saw strong spare parts purchasing, contributing to over 20% growth in spare parts revenue. Internal shop visit revenue increased by 11%.

Supply Chain and Production:

Supply chain constraints remain a focus area. GE Aerospace is using its operating model, FLIGHT DECK, to address these issues, driving an 8% sequential increase in material inputs from priority suppliers.

RTX is also focused on its supply chain; Collins saw overdue line items across all suppliers down over 20% versus the prior year, and Raytheon's material receipts were up for the eighth consecutive quarter.

GE Aerospace's pace of engine deliveries was hampered by the supply chain for specialized components in the prior year, leading to some delayed deliveries for airframe manufacturers like Airbus. Measures are being taken to improve component availability. Safran delivered 319 LEAP engines in Q1 2025, down from 367 in Q1 2024, reflecting softer production at the start of the year, though favorable customer mix offset lower volume in revenue terms.

Impact and Management of Tariffs

Tariffs have emerged as a significant topic, adding uncertainty to the operating environment. Generally, the aerospace and defense sector has operated in a duty-free environment, which has been instrumental in maintaining a large trade surplus for American manufacturing.

RTX management stated their outlook does not incorporate the impact of recently enacted incremental U.S. and non-U.S. tariffs, although the potential impact could be as high as $850 million. They are working to mitigate tariffs through various means, including exemptions, exclusions, and operational changes. Morningstar analysts see quite limited risk for RTX from potential import or export tariffs due to offsetting customs provisions and restricted defense supply sources.

GE Aerospace included the impact of announced tariffs, net of company actions, in its full-year guidance. While GE Aerospace faced a $500 million tariff-related headwind, this was accounted for in their guidance, which was left unchanged. GE Aerospace is working to offset tariff impacts by optimizing operations, focusing on costs, and raising some prices. They plan their typical catalog price increases for spare parts in the late summer, aiming for mid to high single-digit increases, consistent with prior expectations.

Company Valuations and Competitive Advantages (Moats)

Analysts view these companies as possessing significant competitive advantages, often referred to as "moats," particularly in their aerospace segments.

The aerospace and defense industry is characterized by substantial upfront development costs for programs that pay out over decades. Suppliers recoup these costs over many years and become trusted partners. Due to the critical nature of aerospace components like engines, customers are unlikely to switch to untrusted producers. The long-standing oligopoly in the market is indicative of the high barrier to entry.

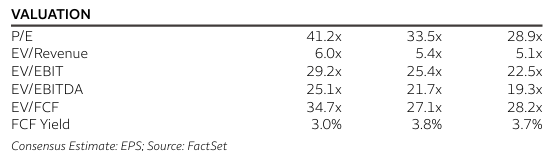

RTX's Collins Aerospace, Pratt & Whitney, and Raytheon segments are seen as having wide moats. Pratt & Whitney competes in a duopoly with CFM (a GE Aerospace/Safran joint venture) in the narrow-body jet market, with its GTF engine having about a 42% share on current Airbus A320neo orders. Morningstar's fair value estimate for RTX is $134.00.

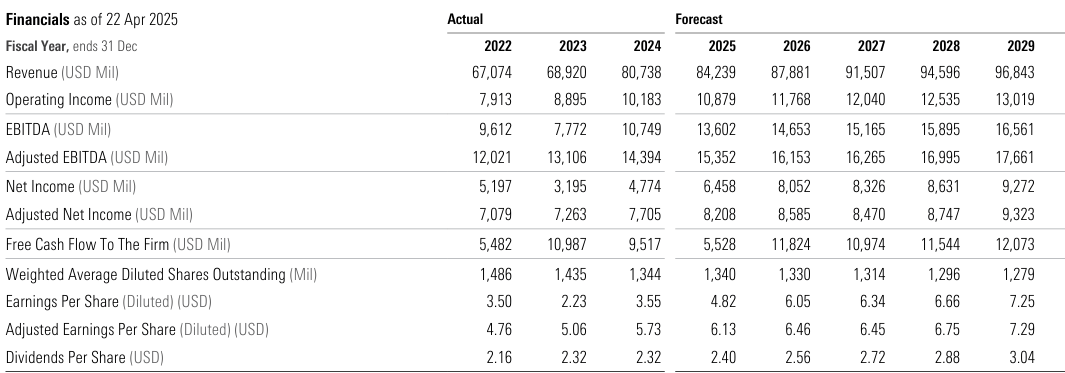

GE Aerospace is also seen as having a wide moat. GE Aerospace powers about three out of four commercial airline flights globally. The jet engine business involves significant R&D for new engines and substantial revenue from servicing existing engines over their long service lives. GE Aerospace earns about three-fourths of its commercial engine revenue from services, with 70% of that service revenue coming from servicing its own engines. This large installed base allows GE Aerospace to command approximately 40% of the global commercial engine services market, reinforcing its moat. GE Aerospace's operating margins in the commercial engine segment are noted to exceed Pratt & Whitney's, demonstrating the scale benefits of its large installed base. Morningstar's fair value estimate for GE Aerospace is $198.00. Wells Fargo has a price target of $222.00 for GE.

Risks

Key risks facing these companies and the aerospace industry include:

Potential impacts from tariffs and counter-tariffs.

Ongoing disruption to the aerospace supply chain, potentially hampering operations and profitability.

The costs associated with the identified rare condition in powder metal used in certain Pratt & Whitney GTF engine parts, requiring accelerated removals and inspections, which will continue for a few more years. This issue may also potentially impact other engine models.

Changes in U.S. government policy, defense spending, or uncertain program funding.

Global economic conditions, including potential recession, and geopolitical risks.

Challenges in managing strategic initiatives like cost reduction and restructuring.

Changes in aircraft production volumes by major customers like Boeing or Airbus due to their own challenges.

Risks related to product safety, quality issues, or performance.

Factors that could negatively affect demand or the financial strength of airframers, airlines, and suppliers.

Forward Look

Despite uncertainties in the broader environment, companies like GE Aerospace and RTX are leveraging strong backlogs and taking actions to navigate challenges such as supply chain constraints and tariffs. Demand for aftermarket services is expected to remain robust as aircraft fly and require maintenance. Both GE Aerospace and RTX maintained their full-year guidance, excluding the potential impact of tariffs for RTX. Safran also confirmed its full-year 2025 outlook, excluding any potential tariff impact.